Washington state homebuyers in flood-prone areas are stranded amid government shutdown

Published in News & Features

SEATTLE — It's October. Halloween decorations are up. Leaves are changing colors. Pumpkin spice lattes are back. And it is time to think about floods.

The state has nailed the timing for its flood awareness month, with a level 1 Flash Flood threat for parts of southern coastal Washington starting Friday. Unfortunately, this year, October brought a government shutdown that has tied the hands of many seeking flood insurance — making the month a whole lot scarier for those living near the water.

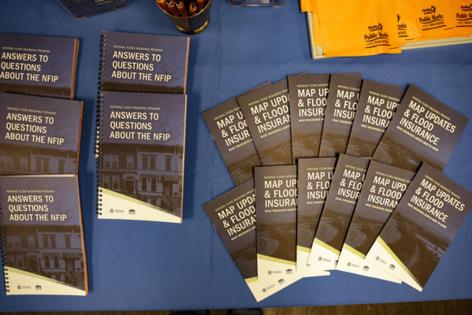

The government shutdown has paused the federal government’s National Flood Insurance Program, which provides the vast majority of flood insurance nationwide. Flood insurance is required for closing on homes in flood-prone areas of the country, including many in Washington state, already leading to delays on closing homes.

Flood damage isn’t covered by standard home insurance policies. But mortgage lenders need to protect their investment, so they require a buyer to have flood insurance before closing homes in areas highly susceptible to floods.

Around 36,000 people in Washington have flood insurance policies because of that requirement, according to the Washington State Office of the Insurance Commissioner, although more than 2 million people in Washington live in areas susceptible to flooding.

Despite the pause, the federal program will continue to pay claims for its policyholders, but processing and payment of claims could face delays.

Any of those millions of residents who want to buy government flood insurance in preparation for Washington’s flood season, which lasts from October until April, is out of luck until the government reopens.

“People are certainly worried,” said John Manning, an agent at REMAX Gateway. “And, of course, the longer the shutdown goes on, the more likely it is that those worries will come to pass.”

Wes Graham, a mortgage broker in North Bend, often has clients buying homes near the Snoqualmie River.

One of his clients has been trying for weeks to close on a home that requires flood insurance, but needs to wait for the government to reopen until flood insurance can be purchased. Private insurance premiums were three to four times higher than what the federal government offered, and that’s out of his client’s price range.

“There are no other affordable options,” Graham said.

The federal government created the National Flood Insurance Program in 1968 because many people couldn’t afford the premiums charged by private flood insurance companies, or lived in an area so prone to flooding that private insurance denied coverage.

The average premium of National Flood Insurance Program policies in Washington is $936.

Some can find private flood insurance for cheaper, but it depends on how vulnerable an area is to floods. Private insurance can decline to cover a high-risk property, whereas the government usually cannot. Around one-fifth of Washington’s flood insurance policies are private, according to the Washington State Office of the Insurance Commissioner.

Although private insurance isn’t an option for Graham’s client, the sellers of the home he plans to buy are being patient, he said. Still, Graham worries about how long the government shutdown will last.

This government shutdown, which started Oct. 1, is on track to be one of the longest in U.S. history. The most recent (and lengthiest) government shutdown lasted 34 days under the Trump administration in 2018. It’s possible the government could face a backlog of requests for policies and renewals when it opens.

“Who knows what line my client is going to be in?” Graham said.

The National Association of Realtors estimates that the National Flood Insurance Program’s lapse threatens 1,400 transactions a day across the country.

It’s still unclear how much of an impact the government shutdown will have on overall home sales in Washington, said Windermere principal economist Jeff Tucker.

FHA and VA loan applications may take longer to process with reduced federal staff. The U.S. Department of Agriculture has halted the issuance of new loans, a zero-down-payment mortgage loan for people in rural areas with low or moderate incomes.

Until data on home closings comes out next month, it’s difficult to say what kind of impact the government shutdown has had on regional housing markets. So far, delayed closings don’t seem to be a significant problem in Washington, Tucker said, but as the shutdown continues, that could change.

“How long it lasts makes a really big difference,” Tucker said. “I think a lot of people are on edge, waiting to see what those impacts are.”

_____

© 2025 The Seattle Times. Visit www.seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments