There's a new congressional effort to address housing affordability

Published in Political News

Calling it an effort to “save the ‘American dream,’” a bipartisan cohort of House members has teamed up to address housing affordability issues across the country.

They are starting with identifying the factors that are impeding home ownership.

The newly introduced bill would create an interagency task force to address mortgage, housing construction and insurance costs, as well as down payment assistance, disaster resilience and federal housing finance programs. It would involve the U.S. Department of Housing and Urban Development, as well as the federal Agriculture, Veterans Affairs, and Treasury departments and the Federal Housing Finance Agency.

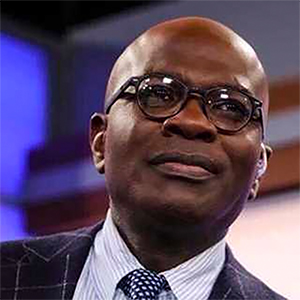

The idea, said Rep. Lou Correa, a Santa Ana, Calif., Democrat and one of the bill’s authors, is to equip lawmakers with more information so they can better understand the issues that are preventing people from being able to buy a home and figure out what policies should be prioritized.

“It’s about getting people to think about housing as a major problem and how it’s leading to homelessness, how lack of housing is leading to people not being able to sustain themselves as a middle class, not being part of the upward mobility,” said Correa.

Rising housing prices have risen faster than median household incomes, a growing roadblock for working families to be able to own homes, a recent study from the Urban Institute, a Washington, D.C.-based economic think tank, found.

“When we look at 35-to-44-year-olds — a group that is established in their careers, often raising children and considered to be in their critical homebuying years — we see a drop greater than 10% in the homeownership rate overall,” the study found.

For those in California, $232,400 was the required income in the spring to be able to buy a house at the state’s median price of $905,680. That’s an increase of 17% in three years, a Southern California News Group analysis found, and means only 15% of California households can afford to buy a house compared to 16% in 2022.

Correa said he remembers his family saving pennies in order to qualify for a loan and make a down payment when purchasing a home for the first time.

“Making the jump was painful, but you felt a change in your life. I felt a change,” Correa said, recalling how his family would jump from apartment to apartment, the possibility of an eviction hanging overhead. But then his parents became homeowners.

“That was the moment we went from trying to make it, trying to be middle class, to being middle class,” Correa said.

But today, Correa said, “young people don’t even think about buying a house anymore. It’s beyond their dreams.”

The bill is championed by Correa as well as fellow chairs of the Congressional Real Estate Caucus: Reps. Mark Alford, R-Missouri; Tracey Mann, R-Kansas; and Brittany Pettersen, D-Colorado.

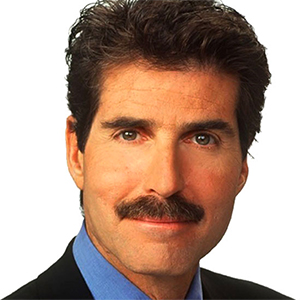

This bill is the first step, said Alford, in ensuring the federal government is working toward solutions to home ownership impediments.

“We can suggest things all day long. We can have hearings, can go back and have field hearings in our districts and meet until we’re blue in the face, but until these agencies … all get together and keep the ‘American dream’ alive, we won’t have real action,” Alford said.

Alford, a former real estate agent who represents rural Missouri communities as well as the Kansas City suburbs in Congress, said property is one of the best investments someone can make. But since home ownership has been out of reach for many younger people, there isn’t that connection to those benefits, such as equity and lines of credit, he said.

While he doesn’t disparage those who prioritize travel and experiences over purchasing a house, “there is something different about owning a home and investing your time and energy into a place to make memories, into something that’s lasting,” Alford said.

California Reps. Ken Calvert, R-Corona, and Brad Sherman, D-Sherman Oaks, are also among those already backing the bill.

_____

©2025 MediaNews Group, Inc. Visit ocregister.com. Distributed by Tribune Content Agency, LLC.

Comments