Senate's next crypto bill slowed by language in stablecoin law

Published in Political News

WASHINGTON — One of the lawmakers working on the Senate Banking Committee’s next iteration of crypto legislation doesn’t want to revisit a provision in earlier legislation prohibiting stablecoin issuers from offering interest because she’s got her hands full advancing the latest bill.

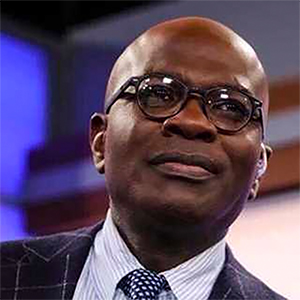

Sen. Cynthia Lummis, R-Wyo., is resisting efforts from some Republicans and Democrats to change the interest language that the banking industry says creates a loophole for cryptocurrency exchanges to offer rewards, effectively enabling them to pay interest. The stablecoin bill was enacted into law in July.

“I’m of the opinion that we should leave the stablecoin bill alone,” Lummis, chairman of the Senate Banking Subcommittee on Digital Assets, told reporters last week. “We’ve got enough problems with market structure.”

The crypto industry has launched a campaign to keep the stablecoin rewards policy intact. Crypto exchange rewards are incentives, such as additional crypto payments and bonuses, the platforms give users who create new accounts, refer new customers, use their crypto to bolster a blockchain network or make purchases with a crypto card, among other activities.

Opponents of crypto interest want the rewards issue addressed in legislation that the committee is now cobbling together. The new bill, known as market structure legislation, would establish rules for the operations and oversight of digital assets markets.

Sen. Bill Hagerty, R-Tenn., who sponsored the stablecoin bill, acknowledged the question of crypto interest is thorny.

“This is something that’s going to require a lot more attention from my colleagues to address,” he said last week. “Everything is up in the air.”

Senate Banking Republicans updated last month a discussion draft of the market structure bill that Chairman Tim Scott, R-S.C., had hoped to mark up by the end of September. That deadline was missed because of obstacles the bill has encountered.

One is the showdown between the banking and crypto lobbies over stablecoin interest.

Another is how the bill would address so-called decentralized finance. A dozen crypto-friendly Senate Democrats offered a proposal recently that was shot down by Republicans and the crypto industry.

The Democrats also said they wanted the market structure legislation to preserve the intent of the “prohibition on interest or yield paid by stablecoin issuers, including indirectly or through affiliates.”

Scott appears to be focused on the Democrats’ concerns rather than the Republicans’ concerns with crypto exchanges’ rewards.

Scott delayed a markup to give Democrats time to “substantively engage on legislative text,” his spokesperson Jeff Naft wrote in an email. Since June, the committee has held a hearing and released principles and discussion drafts that reflect a wide range of input — but not from Democrats, he added.

“Despite repeated requests for edits and redlines from Democrats, they have yet to provide formal feedback or agree to a markup date,” Naft said. “The Chairman remains optimistic that Democrats will return to the negotiating table, engage in good-faith efforts to finalize the text, and set a markup date as soon as possible to deliver the regulatory clarity America’s digital asset industry needs to thrive.”

Lawmakers are hesitant to predict when the committee might get to a market structure markup.

“We’re trying to get a date for a markup,” Lummis said. When might that be? “When we can agree on a date for a markup.”

On top of differences over legislative substance, the effort to advance the bill is overshadowed by the thing hanging over all Capitol Hill activity: the partial government shutdown.

Democrats have indicated they want to agree on the base text of a bill before going into a markup.

The stablecoin bill drew 18 Democratic votes on final passage in the Senate. Scott says he wants to achieve similar success across the aisle with market structure legislation. But it might be a more difficult task.

“This time, Democrats are holding together a lot more than they were with stablecoins,” said a banking industry lobbyist who asked not to be identified.

Republican crypto interest concerns

That some Republicans have voiced concerns about potential crypto interest payments is a breakthrough for the banks’ messaging efforts, said a person familiar with the situation.

Sen. Mike Rounds, R-S.D., is one of the Republicans leery of crypto interest.

“We want to make clear, very clear that the intent of the original language of the [stablecoins bill] was that they could not offer interest,” Rounds, a Senate Banking Committee member, told reporters last week. “If there’s a way around that, then the only question is, do you fix that by rule, through Treasury, or do you have to fix it with a specific piece of legislation? I’m open to either one.”

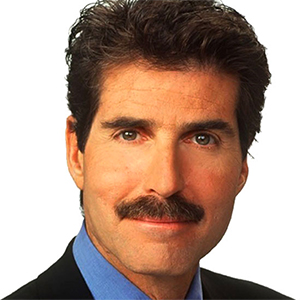

Sen. John Kennedy, R-La., another Senate Banking Committee member, said lawmakers don’t have a good grasp of the bill.

“The biggest problem with it right now is nobody understands it,” Kennedy told reporters last week. “We haven’t had enough hearings.”

In a floor speech, Kennedy called for at least two more hearings on the market structure legislation.

“I hope we’ll move it quickly, but I hope we’ll move deliberately,” he said.

Crypto advocates have been pushing to get market structure done this year. One of them agreed with Kennedy’s approach.

“The Senate must act quickly and deliberately to pass market structure legislation,” Mason Lynaugh, community director for Stand with Crypto, said in a statement. “Congress has the opportunity to make America the definitive leader in the crypto industry, and that can only be achieved through market structure legislation. Even during the shutdown, advocates are fired up about this possibility and are reaching out to their members to get this done.”

The group said it sent more than 320,000 letters from more than 160,000 participants to most Senate offices over the last two weeks in a campaign to “to reject a new anti-consumer push from the banking industry that seeks to claw back stablecoin rewards.”

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments